Our library of helpful tips & tricks for managing your business and finances, provided to you by OneHQ Accounting.

From 13 November, all businesses with an ABN, excluding sole traders, need to nominate a registered agent in Online services for business if:

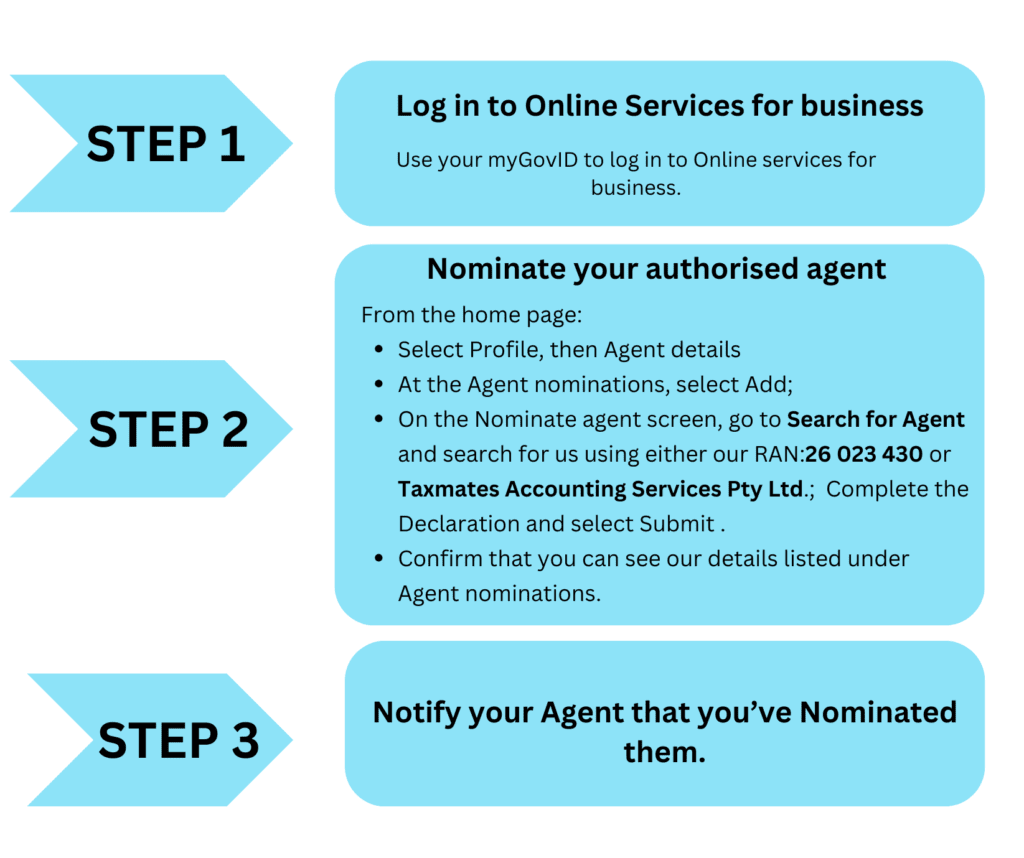

You’ll need to use the updated agent details feature in Online services for business to authorise an agent before they can link to your accounts.

You don’t need to do anything if your existing agent arrangements remain the same.

Client-to-agent linking has been introduced for several reasons, primarily focusing on enhanced security.

The introduction of client-to-agent linking brings a substantial improvement to the security of online tax services. In the past, there were concerns about the risk of fraudulent agents or hackers creating unauthorised accounts or submitting false returns on your behalf. This change ensures only trusted professionals have access to your financial data.

Client-to-agent linking prioritises your privacy, ensuring you have control over who can access your financial information. You can have confidence that your sensitive financial data remains confidential and is accessible solely to authorised individuals. This added layer of protection ensures the security and privacy of your financial affairs.

If you already have done this step then you can ignore step 1. You will know if you’ve done it if you can generally access each of your entities / businesses using Online Services for Businesses.

If you have not done this step, you will need to do the below:

This step is what gives authority for your new accountant to access the business records. You will need to do this for each of your entities / businesses:

Once the above process has been done for each entity / business – let your Tax Agent know, they will then have a window of time (28 days) to process the nomination.

You can find more information and details directly from the ATO website here.